What is an IRS Ein confirmation letter? Can I request a new confirmation letter? How do I Find my Ein confirmation letter? How to obtain a confirmation letter for an assigned Ein number?

Getting a replacement confirmation letter for your Tax ID Number is as simple as calling up the IRS. If you remember your EIN number, you can have the form faxed directly to you.

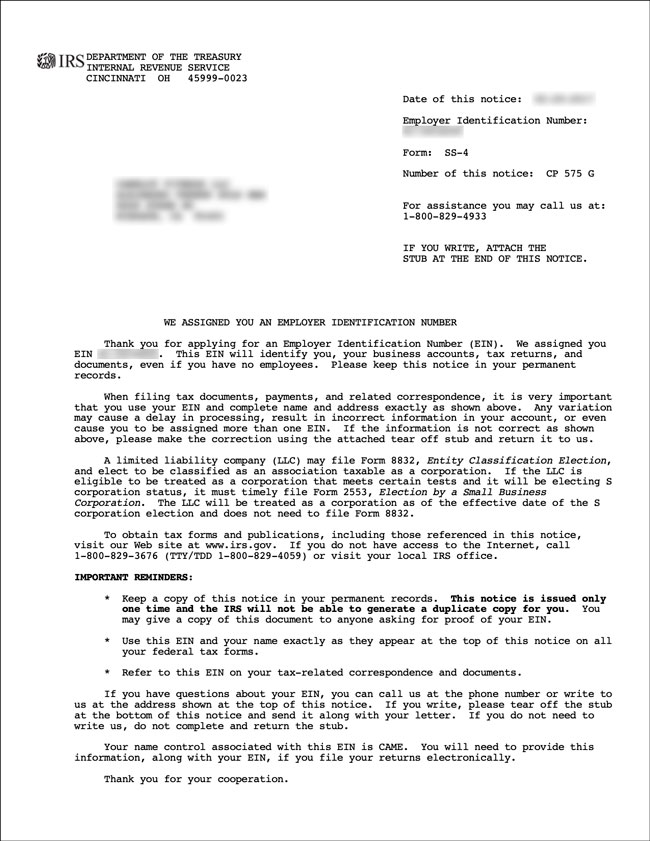

The EIN confirmation letter is sent to the address provided on the SS-form, eight to ten weeks following the issuance of the Federal Tax ID Number. However, if you choose to apply online, a copy of the letter is viewable, printable, and ready for download directly from the IRS website as soon as the process is complete. For every EIN application that is done, an EIN confirmation letter is sent out by the IRS.

It is called CP 575. The IRS mails the letter to your address listed in the SS-application within eight to ten weeks of giving your company a Federal Tax Identification Number. This EIN confirmation letter is called CP 5, and the IRS mails it to the address listed on the SS-application within eight to ten weeks of issuing your company a Federal Tax ID Number. Sometimes your company’s bank or a vendor may request to see this confirmation letter.

For those who are unfamiliar with the EIN verification letter, it is a confirmation letter that the IRS sends out for every EIN application it processes. This EIN verification letter is called CP 57 and the IRS mails it to the address listed on the SS-application within eight to ten weeks of issuing your company a Federal Tax ID Number. If you have lost your EIN Verification Letter from the Department of Treasury, you can request a new one.

Requesting a letter is free. US is a very simple process: 1. Select the button above that represents your business or Tax ID needs. Answer a simplified form about yourself and about the business entity.

Conclude the transaction and submit. Find the computer-generated notice that was issued by the IRS when you applied for your EIN. This notice is issued as a confirmation of your application for, and receipt of an EIN. If you used your EIN to open a bank account, or apply for any type of state or local license, you should contact the bank or agency to secure your EIN.

When paper or faxed Forms SS-are received by the IRS with information missing, additional time is needed to process that application, delaying the issuance of your Employer Identification Number. Applicants can get their EIN much quicker if all the required information is completed.

The IRS will send you a request letter receipt when they receive your EIN letter request. In this, you will be told about the timeframe to when you will receive the number. This is normally a two weeks time.

Contact the IRS if you have waited for more than two weeks for the confirmation letter, and inquire about the delay. You might not have your original Form SS-which you can provide to the IRS to obtain your EIN, however, you the IRS provides a confirmation letter to every business owner once their EIN is officially registered so you might still have that hanging around somewhere.

EIN Confirmation Letter Before we get into other methods, do yourself a favor and dig around for your EIN confirmation letter. The EIN verification letter is also called the CP 575.

If you know where this form is, you already have the letter you need. You should have received this letter within eight to weeks after the IRS approved your EIN application. The IRS will use the address that you provided on the application form, so be sure you check the right mailbox. If you lost your original letter and need to confirm your EIN - the IRS will send you the letter 147C that may be used when you are asked CP5Letter.

Also - in lieu of the IRS Form CP57 the applicant may use any official correspondence, such as the quarterly tax payment coupon, from the IRS showing the name of the entity as shown on the application and the EIN. HOW TO REQUEST A RETRIEVAL OR A 147c VERIFICATION LETTER 1. Click one of the buttons above to select the type of service you need. In the letter to the IRS, the company must indicate the reason for closing its EIN account.

Closing your EIN account becomes an easier task if you submit the EIN assignment notice you received when the EIN was initially assigned to the business.

Hiç yorum yok:

Yorum Gönder